|

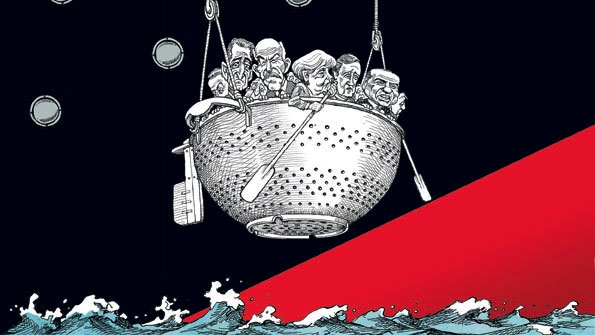

This

week’s summit was supposed to put an end to the euro

crisis. It hasn’t

Europe’s

rescue plan

The

Economist, October 29th 2011

You

can understand the self–congratulation. In the early hours

of October 27th, after marathon talks, the leaders of the

euro zone agreed on a “comprehensive package” to dispel

the crisis that has been plaguing the euro zone for almost

two years. They boosted a fund designed to shore up the euro

zone’s troubled sovereign borrowers, drafted a plan to

restore Europe’s banks, radically cut Greece’s burden of

debt, and set out some ways to put the governance of the

euro on a proper footing. After a summer overshadowed by the

threat of financial collapse, they had shown the markets who

was boss.

Yet

in the light of day, the holes in the rescue plan are plain

to see. The scheme is confused and unconvincing. Confused,

because its financial engineering is too clever by half and

vulnerable to unintended consequences. Unconvincing, because

too many details are missing and the scheme at its core is

not up to the job of safeguarding the euro.

This

is the euro zone’s third comprehensive package this year.

It is unlikely to be its last.

Words

are cheap…

The

summit’s most notable achievement was to forge an

agreement to write down the Greek debt held by the private

sector by 50%. This newspaper has long argued for such a

move. Yet an essential counterpart to the Greek writedown is

a credible firewall around heavily indebted yet solvent

borrowers such as Italy. That is the only way of restoring

confidence and protecting European banks’ balance-sheets,

thus ensuring that they can get on with the business of

lending.

Unfortunately

the euro zone’s firewall is the weakest part of the deal.

Europe’s main rescue fund, the European Financial

Stability Facility (EFSF), does not have enough money to

withstand a run on Italy and Spain. Germany and the European

Central Bank (ECB) have ruled out the only source of

unlimited support: the central bank itself. The euro

zone’s northern creditor governments have refused to put

more of their own money into the pot.

Instead

they have come up with two schemes to stretch the EFSF. One

is to use it to insure the first losses if any new bonds are

written down. In theory, this means that the rescue fund’s

power could be magnified several times. But in practice,

such “credit enhancement” may not yield much. Bond

markets may be suspicious of guarantees made by countries

that would themselves be vulnerable if their over-indebted

neighbours suffered turmoil.

Under

the second scheme, the EFSF would create a set of

special-purpose vehicles financed by other investors,

including sovereign-wealth funds. Again, there are reasons

to doubt whether this will work. Each vehicle seems to be

dedicated to a single country, so risk is not spread. And

why should China or Brazil invest a lot in them when Germany

is holding back from putting in more money?

Together,

these schemes are supposed to extend the value of the EFSF

to €1 trillion ($1.4 trillion) or more. Sadly, that looks

more like an aspiration than a prediction. And because the

EFSF bears the first losses, its capital is at greater risk

of being wiped out than under a loan programme. This could

taint France, which finances the rescue fund and has

recently seen its AAA credit rating come under threat. Since

the EFSF depends partly on France for its own credit rating,

a French downgrade could undermine the rescue fund just when

it is most needed.

If

the foundations of the firewall are too shallow, then the

bank plan plunges too deep. By the end of June 2012, banks

are expected to establish a core-capital ratio of 9%. In

principle, that is laudable. But if banks have months to

reach their target, they can avoid raising new equity, which

would dilute their shareholders' stakes, and instead move to

the required ratio by shrinking their balance-sheets. That

would be a terrible outcome: by depriving Europe’s economy

of credit, it would worsen the downturn.

Then

there is Greece. Although the size of the writedown is

welcome, euro-zone leaders are desperate for it to be

“voluntary”. That is because a default would trigger the

bond-insurance contracts called credit-default swaps (CDSs).

The fear is that a default could lead to chaos, because the

CDS market is untested. That is true, but this implausibly

large “voluntary” writedown will lead investors in other

European sovereign bonds to doubt whether CDSs offer much

protection. So while the EFSF scheme is designed to offer

insurance to bondholders, the European leaders’ insistence

that the Greek writedown be voluntary will make euro-zone

debt harder to insure.

…but

trust is nowhere to be found

Europe

has got to this point because German politicians are

convinced that without market pressure the euro zone’s

troubled economies will slacken their efforts at reform.

Despite a list of promises presented to the summit by Silvio

Berlusconi, Italy’s prime minister, Germany has good

reason to worry. But it needs to concentrate on

institutional ways of disciplining profligate governments,

rather than starving the rescue package of funds. As it is,

this deal at best fails to solve the euro crisis; at worst

it may even make it worse. As the shortcomings of each

component become clear, investors’ fears will surely

return, bond yields will rise and banks’ funding problems

will worsen.

Yet

again, disaster will loom. And yet again, the ECB will end

up staving it off. Fortunately, Mario Draghi, the ECB’s

incoming president, made it clear this week that he realises

that is his job. But therein lies the tragedy of this

summit. An ECB pledge of unlimited backing for solvent

governments would have had a far better chance of solving

the crisis months ago, and remains the best option today.

At

this summit Europe’s leaders had hoped to prove that their

resolve to back the euro was greater than the markets’

capacity to bet against it. For all the backslapping and

brave words, they have once again failed. There will be more

crises, and further summits. By the time they settle on a

solution that works, the costs will have risen still

further.

The

euro deal: No big bazooka

Europe’s

leaders have agreed on how to prop up the euro. For now

The

Economist, October 29th 2011

Brussels.–

It was four in the morning in the Justus Lipsius building in

Brussels when word at last filtered out that, after nearly

ten hours of arduous bargaining, the euro zone’s leaders

had reached the long-promised “comprehensive” deal to

save the euro. Diplomats called contacts in the sanctum to

find out what, precisely, had been agreed. “We think we

have an agreement, but we are not sure what it is,” came

the reply from one weary negotiator.

By

their own admission, the leaders themselves at times

struggled to understand the complex financial engineering

which they were being asked to approve to turn their

inadequate financial slingshot into the “big bazooka”

that the world had asked them to assemble. But by dawn on

October 27th they could proudly announce a “comprehensive

set of additional measures reflecting our strong

determination to do whatever is required to overcome the

present difficulties”.

The

result was better than some had dared hope. Just a week

earlier the summitry had seemed doomed, with Angela Merkel,

the German chancellor, rejecting a push by Nicolas Sarkozy,

France’s president, to boost the euro zone’s bail-out

fund by allowing it to borrow money from the European

Central Bank (ECB). Unable to cancel a summit planned for

October 23rd, the leaders decided instead to call a second

one three days later. The ruse worked; the discussions, said

one participant, had gone “from worse to bad to better”.

Markets rejoiced.

But

is it a good deal? This was, after all, the third

“comprehensive solution” devised by the euro zone so far

this year. With each “unprecedented” effort, the problem

has only worsened (see chart 1). Sadly, this latest deal

promises to be no more enduring. At best, it will buy time

before the next round of panic. At worst, it may push the

euro zone into catastrophe. “This is certainly no summit

to end all summits,” said Sony Kapoor, managing director

of Re-Define, an economic think-tank in Brussels. “Once

again, good economics has fallen victim to bad politics.”

The

package consists of three connected parts: reducing

Greece’s debt to a sustainable level by a “voluntary”

agreement with private creditors to accept the loss of half

the value of the bonds, in exchange for safer debt;

recapitalising Europe’s banks to the tune of €106

billion ($146 billion) to help them absorb the losses on

Greek and other distressed debts; and creating a €1

trillion firewall to prevent the spread of panic to

vulnerable, bigger but still-solvent states, above all

Italy, the euro-zone country with the second-biggest debt

burden. In the word of one well-placed source, “the more

zeroes the better”. The trouble is, the more zeroes are

added, the more holes are likely to be found in the plan.

The

good news is that the euro zone has woken up from the lie

that Greece could one day repay its debts. A supposedly

confidential new assessment of Greece’s prospects, drawn

up earlier this month by the “troika” of the ECB, the

IMF and the European Commission, makes dire reading.

Austerity has pushed Greece further into recession than

expected; this year output is expected to shrink by 5.5%,

and the country will not return to growth until 2013.

Moreover, structural reforms to boost growth have been

implemented slowly while the forecast for European economies

has dimmed, further darkening the outlook for Greece. As a

result, the report found that its debt would probably peak

at about 186% of GDP in 2013, instead of the 160% predicted

three months earlier, even with a 21% haircut on debt held

by private creditors that was agreed on in July. If the euro

zone and IMF wanted to avoid lending more billions to

Greece, private creditors would have to take much bigger

losses.

So

alongside the bad-tempered bargaining among politicians,

there was an equally arduous negotiation with Greece’s

creditors. At one point on October 26th Mrs Merkel and Mr

Sarkozy broke away from the summit to bargain with bankers.

The banks would not accept the troika’s bleak forecast. A

paper produced recently by the Institute of International

Finance, a club of big banks that has been negotiating debt

forgiveness on their behalf, argued that Greece’s public

debt would stand at a hefty, though manageable, 122% of GDP

by 2015. That always seemed fanciful.

In

the end, negotiations settled on a bond exchange that will

cut the face value of Greece’s debt to private creditors

by half. Although the numbers are sketchy, it appears that

Greece’s partners will have to lend €130 billion,

instead of the €109 billion they promised in July. Details

of the bond exchange have still to be negotiated with the

banks, but it is hoped that it will take place early next

year. Taken with the concessionary terms agreed on in July,

the package gives Greece its best chance yet of emerging

from the crisis. “We finally see hope,” said one Greek

official.

The

bond exchange is billed as “voluntary”, but it is not

clear that the International Swaps and Derivatives

Association, a trade body, will agree. If it judges that a

“credit event” has taken place, then payouts will be

triggered on credit-default swaps (CDSs), insurance

contracts against default on government bonds. This is

something that the governments and the ECB had been

determined to avoid, fearing it would lead to financial

catastrophe, rather as the bankruptcy of Lehman Brothers did

in 2008. There is no clarity about who the biggest issuers

of default insurance on Greece are. The net exposure on

Greek CDSs is thought to be less than €4 billion, though

this is likely to be unevenly distributed, with some banks

big winners and others big losers. “You don’t have to be

paranoid to be terrified,” says a senior figure involved

in the deliberations.

Bankrupting

the banks?

Even

if the euro zone succeeds in avoiding CDS payouts, this

could prove a Pyrrhic victory. If losing half the face value

of a bond does not amount to a default, what does?

Undermining the value of CDS insurance could deeply distort

the market. If banks or other investors lose faith in their

ability to hedge risks, they will be tempted to cut back on

risk or demand higher yields. So, perversely, sparing a CDS

payout on Greece could push up the borrowing costs of other

countries.

That

said, the danger of contagion is real. If holders of Greek

bonds can incur losses on what they once thought were safe

investments, what of holders of Italian or Spanish debt? The

initial deal on Greek debt in July was followed in August by

the dumping of Italian and Spanish government bonds.

One

of the obvious channels of contagion is the banking system.

So the 27 governments of the EU—both in and out of the

euro zone—agreed to force banks to take on more capital to

reduce the risk of collapse. The new recapitalisation

package will oblige banks to reach a minimum core Tier-1

capital ratio of 9% (somewhat higher than current

requirements) by the middle of next year, after

recalculating the value of their bond holdings at market

prices. That would mean writedowns of Italian and Spanish

bonds and gains on German and British ones. This will push

much of the burden of raising new capital onto Spanish and

Italian banks while leaving British and German ones largely

unscathed.

The

criteria are suspiciously kind to France. Its banks have

been battered in the markets in recent months, and the

government is alarmed by the prospect of losing its AAA

credit rating. The recapitalisation will be reckoned

according to bond prices on September 30th, when French

ten-year bonds were still yielding 2.6%. Since then the

price has fallen, and the same bonds are now yielding 3.1%.

In all, banks will have to come up with €106 billion in

extra capital. That sounds like a lot, yet it is at the

lower end of many estimates, largely because it will not

include a “stressed” scenario that models the impact of

a recession. That may be a mistake, given the slowdown in

Europe’s economy.

A

far bigger mistake is in the plan’s timetable. Banks are

being given almost nine months to reach the targets,

ostensibly to allow them to raise capital themselves through

cutting dividends or bonuses and selling shares. Yet few

investors are willing to buy bank shares, cheap as they may

seem, given the perceived risks of a series of sovereign

defaults in Europe. This means that the burden would fall

first on national governments and then on the increasingly

stretched resources of the European Financial Stability

Facility (EFSF), Europe’s main bail-out fund.

Given

too much time, moreover, there is the risk that banks will,

in fact, shrink their balance-sheets to bolster their

capital ratios. Their first strategy will be to trim

economically essential but capital-intensive businesses such

as trade finance or lending to small businesses. Huw van

Steenis, an analyst at Morgan Stanley, reckons that European

banks may go on a “crash diet” and cut their

balance-sheets by as much as €2 trillion by the end of

next year. They may also sell government bonds of peripheral

countries, worsening the bond-buyers’ strike that afflicts

Italy and Spain.

Capital

is only one issue facing banks. A second is their own

ability to borrow. The ECB can step in for short-term

funding, but long-term markets are frozen. European banks

have, to all intents and purposes, been unable to issue

bonds since the start of July. Governments could reopen the

market by guaranteeing bonds issued by banks, but they are

wary of putting their own public finances at risk; this was

the path that led to Ireland’s ruin. In any case, few

investors would trust guarantees from Italy or Spain.

Debased

sovereigns

All

this suggests that an essential part of shoring up

Europe’s banks is to restore faith in government bonds.

That means protecting countries, such as Italy and Spain,

that are solvent but have lost the confidence of bond

investors. Even fundamentally solvent countries can quickly

go bust if their borrowing costs rise too fast.

This

is where the EFSF comes in. It was designed to protect

smaller peripheral states. European policymakers insisted it

should have a gold-plated AAA credit rating, lowering its

costs but limiting its capacity. It is now too small to

shield the bigger economies. The EFSF can lend €440

billion (see chart 2). But given its commitments to Ireland,

Portugal, Greece and, perhaps, the recapitalisation of the

banks, it may have as little as €200 billion for future

contingencies. And yet in the next three years Italy and

Spain will have to refinance about €1 trillion-worth of

bonds, not counting additional borrowing to finance their

deficits.

Countries

guaranteeing the EFSF’s funds do not want to increase

their burden, not least because some cannot afford to do so.

France’s AAA rating is already at risk. What is more,

France and the EFSF are like tottering drunks holding one

another up. If France is downgraded, the EFSF will be close

behind.

How

to conjure a bigger EFSF without more taxpayers’ money?

The answer is “leveraging” through financial engineering

of the sort that helped cause the global crisis in the first

place. “If you want leverage, you can always find it,”

says one senior policymaker disdainfully. “Just get two or

three investment bankers in a room.” Herman Van Rompuy,

the president of the European Council, who chaired the

summit, sounds even more cavalier. For centuries, he says,

banks have taken deposits and used them to multiply money.

The

favoured option is to get the EFSF to insure government

bonds, acting, in effect, as the issuer of the much-maligned

credit-default swap. By guaranteeing to take, say, the first

20% of any loss on government bonds, the EFSF could, in

theory, support €1 trillion-worth of Italian and Spanish

debt.

A

second option is to set up SPVs, or Special Purpose

Vehicles. These would seek to attract funds from private

investors or sovereign-wealth funds in Asia and the Middle

East, again by offering to take the first losses in

sovereign defaults. In effect they would be creating

something that looks a lot like the collateralised-debt

obligations (CDOs) that became infamous during the subprime

crisis. How much leverage each vehicle would take on, and

which countries they might apply to, are questions that

still have to be resolved over the next few months.

Many

wonder why any investor would put money into such vehicles

when they can buy bonds directly at a discount or get the

insured version. One reason may be that the direct-insurance

version may breach “negative pledge clauses” in

contracts governing some bonds. These prohibit countries

from doing anything that would set holders of new classes of

debt above those of the old.

A

difficulty with the leverage scheme is that those insuring

the debt of euro-zone issuers would themselves be grievously

weakened if a neighbour defaulted. How credible can their

insurance policy be? “We have really struggled to find

investors who want to buy the ‘part-insured’ government

bonds, for fear the insurance is so highly correlated to the

risk,” says a banker.

An

even bigger problem is that levers can work both ways.

Leverage may enlarge the size of the fund, but it can also

concentrate greater risk onto the sovereigns that guarantee

it. If the EFSF were simply to buy the debt of a vulnerable

country such as Italy, it would expect to get back more than

half of the money even if there were a default with a

relatively high haircut of, say, 40%. If, on the other hand,

it promised to cover the first 20% of losses on the bonds,

then a haircut of just 20% on the value of the insured bonds

could wipe out all the money pledged by the EFSF as

insurance. So instead of assuaging market fears, leveraging

may yet become a mechanism that transmits panic and weakens

the sovereigns, above all France. That is why, in practice,

the EFSF could probably support Spain or perhaps even Italy,

but not both.

Debtor,

save yourself

The

new weapons for the euro zone come with a political price:

closer monitoring of national budgets and economic policies,

particularly in the case of states that need the greatest

help. After a dressing-down from Mrs Merkel and Mr Sarkozy

at the first summit, Italy’s prime minister, Silvio

Berlusconi, came back with a long letter setting out his

promises to reform the economy. In December European leaders

will consider whether they need to change the EU’s

treaties to allow more integration. And there is pressure

for greater harmonisation of taxes. But even if a

re-engineering of the euro zone is possible, such measures

are for the longer term, to avoid a repetition of the crisis

in the future. The priority must be to deal with the

present.

The

euro’s crisis boils down to this: national treasuries do

not have enough spare cash both to guarantee outstanding

debt and maintain their own credit ratings. Even mighty

Germany cannot stand alone behind the whole euro zone.

Some

hope that more money can be found from non-European creditor

countries, such as China, by convincing them to invest in

SPVs. Or perhaps the IMF could do more, particularly if

China increases its contribution to the fund. But even if

the Chinese were game, this raises a serious political

question: does the euro zone want to be so obviously in hock

to China just as it is fretting about Chinese firms buying

up European ones? “If the Chinese are going to chuck money

into an SPV or the IMF there will be a price,” says a

European diplomat. “The Chinese want two things: one is

greater voting rights in the IMF, the other is

market-economy status.” Such status, which is granted by

the EU, would make it harder for the trading block to impose

anti-dumping duties on imports from China.

There

is a better answer: use the unlimited liquidity that only

the ECB can provide by dint of its power to print money. The

ECB could credibly stand ready to buy debt of a country like

Italy. As such, it would be treating a sovereign almost as

it would a bank suffering a run. The danger is that this

will stoke inflation. Germany, in particular, has a deep

aversion to anything that looks like printing money, an

orthodoxy forged in the experience of the Weimar

Republic’s hyperinflation.

The

ECB guards its independence, but has not entirely kept to

these rules; it has already gone into the markets to buy

distressed bonds, ostensibly to ensure that a country’s

bond yields do not stray too far from the interest rates the

bank sets. Having seen off France’s attempt to get the ECB

to lend to sovereigns indirectly, through the EFSF, Germany

removed even a passing exhortation for the ECB to keep

buying bonds from the summit communiqué. “We have no

demands and we have nothing to request,” said Mr Van

Rompuy.

In

private, though, most hope the ECB will not withdraw from

bond-buying. Its incoming president, Mario Draghi, who takes

over from Jean-Claude Trichet on November 1st, has signalled

his willingness to buy bonds to ensure the transmission of

monetary policy. “The blanket prohibition against directly

lending to governments is a complete idiocy,” says Willem

Buiter, chief economist at Citigroup, and a former member of

the Bank of England’s monetary-policy committee. “That

is what central banks do. Just because it can be mismanaged

does not mean you have to throw the tool away. You can drown

in water, but it does not mean you cannot have a glass when

you are thirsty.”

|